Low Doc Lending Is A Great Option

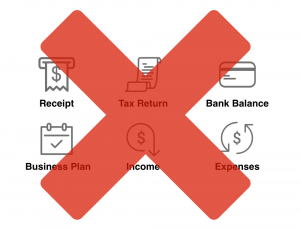

If you are applying for a full doc loan, you are typically required to provide a toolkit of documentation. This might include all income and assets such as revenues, tax returns, cycles of sells, business plans and company financials. For start-ups, entrepreneurs or self-employed; this may be near impossible. This is because the required supporting information is not usually accessible. In addition, traditional banks are making it extremely hard to secure a business loan. Above all, some businesses have complex business structures that are not recognised by traditional banks. Fortunately, Low Doc lending is an option that comes with heaps of opportunity.

Fortunately, there are alternative options out there.

What Is Low Doc Lending?

A low doc business loan doesn’t require the same level of documentation as traditional loans. Also known as unsecured business loans, this fast and accessible loan option is suitable for self-employed or startup businesses that cannot present the necessary documentation for bank finance. A low doc business loan can help your business increase its profits and clear any existing debt. Whilst the documentation required is far, less than banks, lenders may request you to sign an income declaration. Specifically, this document is required to verify your current business income.

As with any loan, there are advantages and disadvantages. We take a look at some of the key differences around low doc business loans.

Advantages

- Fast approval. ALC Commercial may approve the loan within 24 hours.

- Limited documentation required

- ALC Commercial offer loans starting from $10,000 to $3 million.

- Flexible repayment plans

- The right help at the right time

- Lenders can offer a customised loan plan to suit your specific needs

Disadvantages

- High-interest rates. The lender considers a low doc loan as a high risk to them

- Additional fees + charges may be perceived from those who signed the contract

- Deposit is typically higher

- May require collateral

Are They Legal?

Absolutely! Low doc loans are alternative forms of funding. Unfortunately, we can’t all have a perfect collection of tax statements, financial records, and consistent income. As such, alternative lenders offer low doc loans for small business, self-employed and those who do not have all the documentation required.

- Tax returns

- Financial statements

- Proof of consistent income.

Choosing the right lender

There are many finance services who offer low doc unsecured loans. Whilst it is important to compare the associated costs; it is essential to find a lending provider that can offer a flexible and customised loan plan.

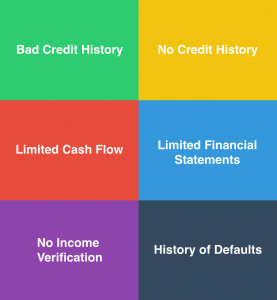

ALC commercial makes it easy to secure a low doc business loan. Whilst we offer flexible loan options, we will consider your application regardless of;

Low doc business loans provide businesses with an opportunity to get back on track.