The Threshold For The Instant Asset Write Off Scheme Has Increased To $30,000.

The Government led scheme has also been extended until June 30, 2020. If you are yet to utilise this money saving scheme, it is time to get started.

What Is The Instant Asset Write Off?

If your business has an asset that decreases in value over time, you can typically claim some deprecation at the end of each financial year. If the asset is expected to last ten years, you may claim back a 10% depreciation for its costs each year.

The Instant Asset Write off scheme allows businesses to improve the speed at which you can make deductions for these purchases. Rather than claiming a 10% deduction on an asset, you can claim depreciation as a one-off lump sum; for multiple assets under the $30,000 threshold.

If you purchase an asset, it must, however, be new or second hand. In order for the business to claim an instant deduction on the asset, it must be installed or ready to use before 7:30 pm AEDT on 2 April 2019.

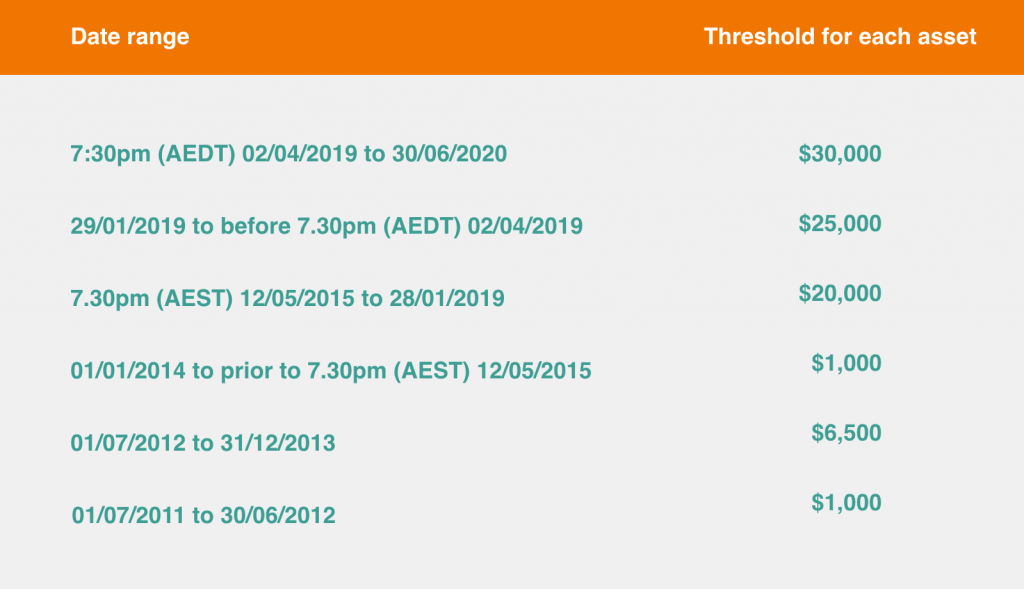

Instant Asset Write off thresholds

The table below outlines the instant asset write off thresholds obtained from the ATO

What assets can you claim?

The following list of assets are eligible for the $30,000, Instant Asset Write Off scheme.

Benefits Of The Instant Asset Write Off

- As a tax deduction, this scheme will decrease your taxable income and tax payable for the financial period.

- More efficient means of investing in your assets.

- You can invest up to 30,000 on equipment and tools

- More importantly, it will allow your business to invest upwards of $30,000 on assets.

- Immediate investment into business equipment that can be utilised straight away.

Utilising The Instant Tax Write Off

Do you find yourself stuck with cash flow problems? Are you unable to utilise the Instant Asset Write off Scheme. There are options out there to help you get the necessary equipment that your business needs. A short term business loan can help in providing fast, short term access to the necessary cash funds.

Caseys Car Park Sweeper

Casey owns a cleaning business. The business has recently acquired a contract to clean pathways. This exciting opportunity has meant that Casey needs to purchase an automatic ride-on sweeper. The machine is valued at $26,000.

The contract is set to begin in 4 weeks. Unfortunately, Casey does not have enough cash flow coming in to purchase the machine and continue paying for her ongoing business expenses.

A short term business loan in this instance has two key benefits to Casey and her cleaning business.

- Quick access to the necessary funds. She can purchase the sweeper and start generating profit from her sweeper.

- The machines total value is less than $30,000. Whilst she has other expenses; she is entitled to declare the machine with the Instant Write off Scheme.

If you are in a similar circumstance, check out ALC Commercial for fast and flexible short term business loans.

Frequently Asked Questions

What do you need to get started?

All you need to get started is:

When does the change take place?

If you purchase an asset that is new or second hand, costing less than $30,000 and the asset has been installed or ready for use before 7:30 pm AEDT on 2 April 2019, it may be claimed as a deduction for the business.

Is my business eligible for the Instant Asset Write off Scheme?

The Instant Asset Write off scheme was originally available to business who had an annual turnover up to 2 million dollars. Following the 2019 changes, the new scheme allows for business with up to $50 million in turnover to use the scheme. In other words, if you have a business that turns over less than $50 million in the financial year, you are eligible to claim the instant write off scheme on multiple assets that total value is less than $30,000.

Is there a limit as to how many assets I can claim back?

No. The ATO has specified that you “may purchase and claim a deduction for multiple assets provided each asset is under the relevant threshold”

If an asset is over $30,000 can I still deduct it?

No. Assets that are over $30,000 cannot be immediately deducted. You can, however, continue to deduct these assets over time, using the small business pool.

What type of assets are excluded?

Whilst many businesses can use the scheme, there are certain restrictions. There are asset classes or types of assets that are excluded from the scheme. Check with your accountant or tax advisor for a clearer picture of your business circumstances. According to the ATO, the following types of assets are excluded;

- Assets that are leased out or expected to be leased out for more than half the time on a depreciating asset lease.

- Assets that have already been allocated to a low-value pool.

- Horticultural plants such as grapevines

- Software development tools

- Capital

Is it smart to take advantage of the instant asset write off scheme?

If your business has the necessary cash flow to support the purchases then the Instant Asset Write off scheme can assist in reducing your taxable income. It is important that your asset is operational in that year or ready to use as you cannot claim the deduction otherwise.