Short term business loans have some major advantages, one of which is that they are so versatile. These specialty fast business loans bridge the gap in an organisation’s finances and can be used for a range of business purposes. Short term loans for Australian businesses can bring opportunities that may otherwise be out of reach. From paying off unexpected expenses, to covering temporary cashflow problems, a short term business loan could be the answer to a temporary business financial shortfall.

ALC Commercial offer fast and flexible short term business loans. Business owners in Australia often choose us because some of our business loans require minimal documentation and also allow you to act quickly on business opportunities. With ALC Commercial, your business loan may be approved within a matter of minutes and settled within 72 hours with less stress and paperwork than the big banks.

At ALC Commercial, our goal is to help your business secure a fast short term business loan, allowing you to act quickly on market opportunities.

Application is fast, obligation-free and won't impact your credit score.

We assess your application as soon as we receive it.

Once you have your loan offer, read thoroughly and sign off.

Short term business loan funds in your account in as little as 48 - 72 hours.

Use your short term finance to accomplish your business goals.

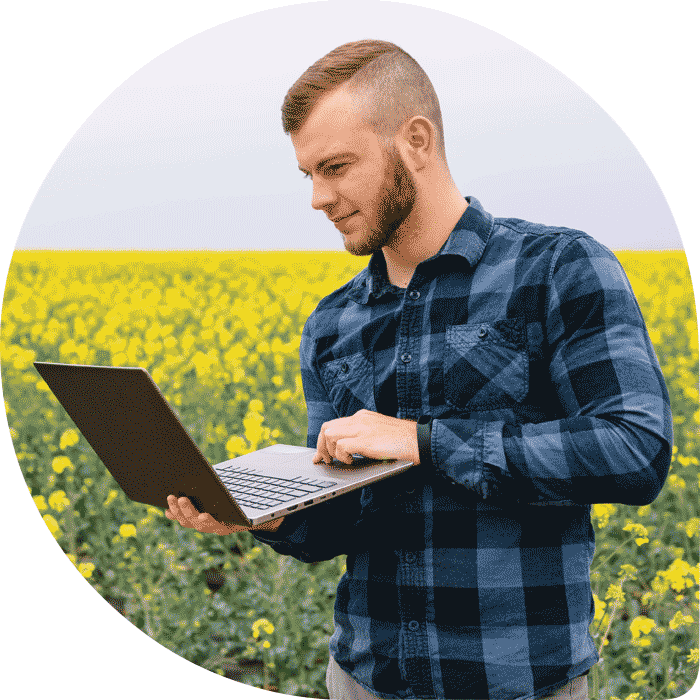

Joe was needed to cover some unprecedented expenses for his agricultural business. The problem was that his expenses hit during his off-season. This meant he didn’t have a stable cash flow to cover them at that time. Joe needed working capital to prepare for his busy season. Joe got in touch with ALC Commercial to help.

The team at ALC Commercial specialist checked out Joe’s unique application and came up with a list of short term business loans to suit Joe’s needs. Joe was able to qualify for his short term loan, and accesses the much needed funds within 72 hours of applying.

ALC Commercial offers tailor-made short term business loan products.

We assess our clients’ unique financial situations and pinpoint the perfect loan product to suit their business’s requirements. With Joe’s case, we understood the agricultural industry was likely to fluctuate depending on the season.

Joe had trouble securing financing through local banks – as they saw him as a risk not an opportunity. As a non-bank lender, ALC Commercial find loan products that to Joe’s benefit regardless of his credit, past defaults, and current (temporary) cash flow issues. Joe applied for a $25,000 short term business loan. He got a competitive interest rate, flexible payment terms and a payment he could afford. Joe’s cash revenue was larger than he expected for the on-season, he was able to repay his loan faster than anticipated.

We rely on our customers to come back when they need fast and simple funding. Many ALC Commercial customer use us for all their short term and long term cash needs. Our customers trust the ALC Commercial specialist team to locate the right business loan solution to get through tough times.

Start-up owners can opt for short term business loans to relieve the financial burden and obtain the necessary capital needed to get up and running.

If your business is growing fast, you might need extra capital for extra inventory, equipment or personnel.A short term business loan can cover this.

When clients don't pay on time, you might need a short term loan to tide your business over until your customers pay their bills.

There are many emergencies that can affect a business, both external and within the company. Short term loans can cover this.