Picture this. You have always dreamt of opening your own restaurant. After searching for the ideal space, you finally found the perfect location. You register the business name. As with starting any new business, there is capital that is required to get the business running normally. Unfortunately, you are low on funds and need the necessary cash to get the ball rolling. After applying for a business loan with the main banks, they all reject your application. They all tell you that “You have bad credit”. Fortunately, bad credit business loans exist.

Traditional banks typically base their loan approval decisions upon your credit score and creditworthiness. As a credit owner, it is important to realize that not paying your debts on time actually leads to a bad rating. Banks will check your capacity to repay a loan, and based their decision upon whether or not you are a reliable customer that will pay back your business loan. If you personally have bad credit, that is a default, judgment or black mark on your credit file; you may find it more difficult to secure a loan.

Your dream, however, is not over. It may be difficult, but it is not impossible. There are options available.

Business Loan with Bad Credit?

One such option is a Bad Credit Business Loan. At ALC Commercial, we understand that bad credit can affect anyone. A bank rejecting your loan is the last thing that you need when opening a new business. ALC Commercial is an alternative lender that offers business loans for people with bad credit. These loans come with fewer lending restrictions. If you, therefore, have a default or a poor credit score, you can apply for a bad credit loan.

Bad credit business lenders may not be able to provide the absolute lowest interest rates, as they are taking on higher risk. What these lenders offer are flexible and immediate loan offers. If you are starting your business or your business is in need of immediate funding support; a bad credit business loan may be your ideal option. Researching the company is also important in making sure that you are partnering with a reputable and trustworthy company tailors its service to meet your needs. Be wary of “loan sharks” otherwise known as alternative lenders offering extremely high interest rates.

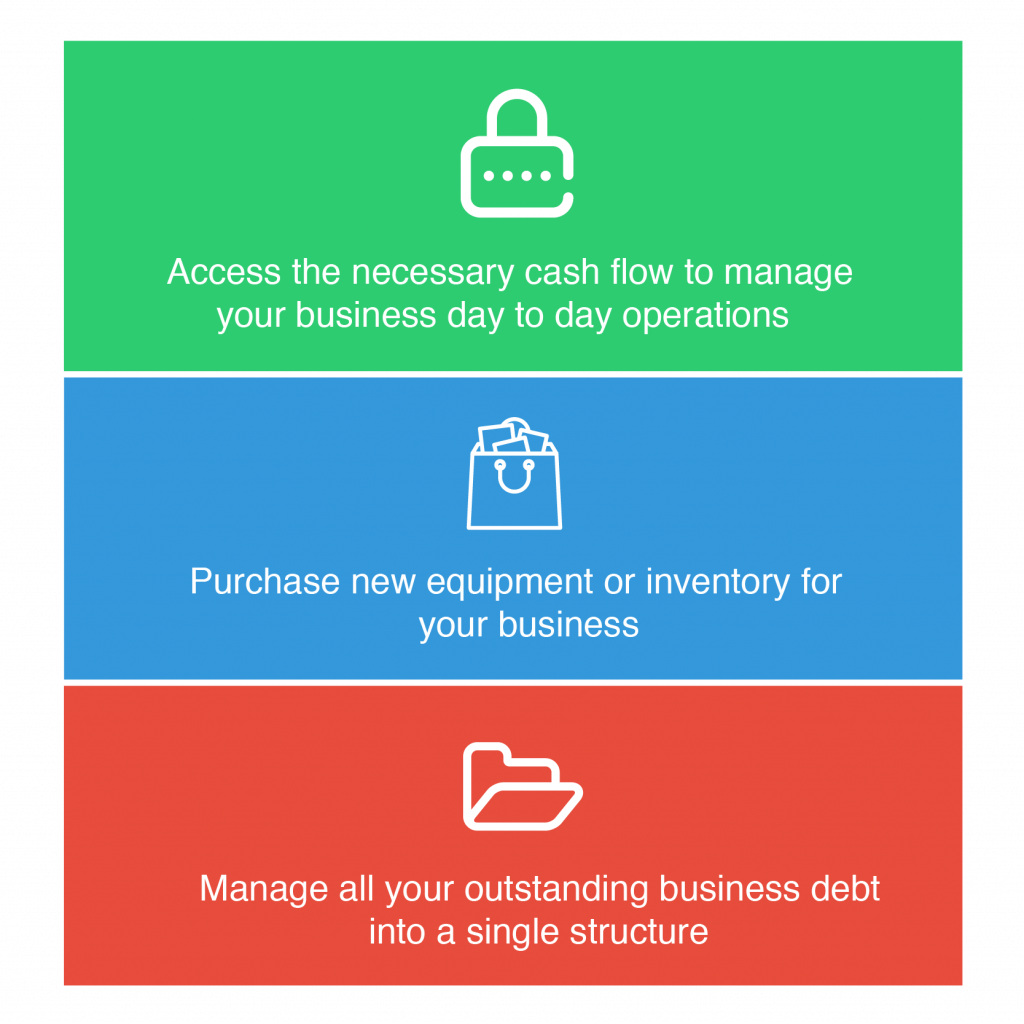

Use your bad credit business loan to:

Features of a Bad Credit Business Loan with ALC Commercial

- No credit check enquiries

- Flexible loan terms(short and long term)

- Fast approval(within 24 hours)

- Bad credit history